News

16.04.2024

Hitachi Report: ZX225USLC-7 at Intermat

Hitachi Construction Machinery Europe (HCME) will showcase the ZX225USLC-7 medium excavator at Intermat in April. Featuring the Zaxis-7 model on stand 6H039, it will be equipped with the Xwatch Leica Geosystems 3D Avoidance System, jointly installed at the HCME factory in Amsterdam.

12.04.2024

Precision agriculture season 2024

New Holland's new parts & service magazine is here! Be the champion of efficiency, thanks to New Holland precision farming solutions.

29.03.2024

Test report: Compact powerhouse Kubota KX085-5

The KX085-5 is the flagship model among Kubota crawler excavators. The machine is meant to be the successor to KX080-4a2, which has many satisfied users. The new machine is supposed to forget its predecessor with more advanced features, improved ergonomics and better performance. Going purely by design, even with a magnifying glass it becomes difficult to see the differences. Urgent changes were not necessary here either, given its still contemporary look. The test machine is equipped with an articulated boom, which brings the own weight to 9,172 kg, over 700 kg more than the boom version.

26.03.2024

Kubota launches conversion kits for a zero-emission future

To provide a solution for customers who want an electric mini-excavator in the near future, Kubota will launch its own conversion kits later this year. With such a kit, consisting of electric motors, a battery pack and the necessary controls, a dealer can convert a new or existing Kubota mini excavator from diesel to electric.

26.03.2024

Entreprise Jerouville chooses quality: Hitachi ZX155W-7

For over half a century, Entreprise Jerouville has been making a big difference in the province of Luxembourg and far beyond, with their extensive work in both the railway sector and public and private works.

We were recently allowed to supply them with 5 new compact excavators on wheels, the Hitachi ZX155W-7.

20.03.2024

INTERMAT 2024

We would like to invite you to INTERMAT, the must-attend event for the building and civil engineering sector. Low carbon will be the key theme of this year's event, which will be organized around 4 key themes: innovation, energy, new equations and CSR commitments.

08.03.2024

PowerBully: Performance. Safety. Comfort.

PowerBully tracked vehicles are made especially for operating in rough terrain: With a payload capacity of over 11.5 tons and minimum ground pressure the off-road tracked vehicles transport bulk solids, materials and attachments to job sites that can’t be reached with wheeled vehicles.07.03.2024

Welcome to our new PowerBully dealer Luyckx

Laupheim, 01.03.2024 – With the beginning of March, PowerBully has a new professional and competent partner for Belgium, Luxembourg and the United Arab Emirates on its side - the long-established company Luyckx in Belgium.

05.02.2024

Yard Entrapaulus Luxembourg

HSB Luxembourg is currently renting out a Hitachi ZX135US-CTA equipped with a telescopic boom with a working depth of 15 metres. Entrapaulus, which specialises in demolition and excavation work, is deploying the machine by excavating a complex construction pit to a depth of 25 metres.

16.01.2024

Kubota Europe will celebrate its 50th Anniversary in 2024

2024 marks the 50th anniversary of Kubota's arrival in Europe with the opening of the first subsidiary in France in 1974. Since then, the company has been showcasing its expertise and reliability, following its For Earth, For Life philosophy. Throughout this year, Kubota will celebrate this event of particular relevance to the Group.

04.12.2023

Delivery of first New Holland T4.100F (stage V)

Kris Aernouts, which specialises in levelling work, has taken delivery of the first T4.100F.

15.11.2023

Hitachi iGround Control November 2023

The autumn edition of the magazine discusses the latest Hitachi news and provides a look at customers and site visits across Europe. It also focuses on celebrating joint success at the dealer meeting, coming up with solutions together and remote monitoring.

Click here to read the magazine.

15.11.2023

5% extra discount on New Holland parts in webshop

From 15/11 to 15/12, enjoy an extra 5% discount on all New Holland parts in our webshop, on top of the current discounts!

For orders over €250, you will also receive a free flashlight.

10.11.2023

Ammann roller ARP 75 for Asfalt Services

Last week, an Ammann roller ARP 75 was delivered to Asfalt Services from Wuustwezel. Asfalt Services is a sister company of F-Build, specialising in infrastructure works.

08.11.2023

Winter maintenance 2023 - 2024: time for a check-up of your New Holland

Are you ready for winter? Make sure your New Holland is too!

07.11.2023

Agribex 2023

We would like to invite you to Agribex, the international fair for agriculture, animal husbandry, garden and green areas.

At the fair, you not only get the chance to meet colleagues from the entire agricultural sector in a relaxed atmosphere, you can also address suppliers in a very targeted way with your specific wishes, expectations and purchase plans.

07.11.2023

Winter offer KUHN spare parts

With the purchase of original KUHN parts worth €500 excl. VAT, you will receive a free KUHN winter jacket!

01.11.2023

Luyckx lights the dark: 5% extra discount on our webshop + free flashlight*

At Luyckx, we want to lighten the dark days of November and December a little. From 1 November to 31 December, you will benefit from an additional 5% discount on all orders through our webshop, on top of the ongoing discounts.

Orders over €250 will also receive a free flashlight.

18.10.2023

Subsidy scheme for battery-powered machines

The subsidy scheme for battery-powered machines is included in the Limitative Technology List of Flanders. This was announced by VLAIO, the point of contact for subsidies and funding in Flanders.

Thanks to the inclusion of this technology, it is possible to apply for an ecology premium of up to 50%*.

01.09.2023

Belgian Scoop: First Electric Ammann Roller eARX 26-2 at BESIX Infra

We are pleased to announce that BESIX Infra will be the proud owner of the very first electrically powered Ammann roller eARX 26-2 in Belgium.

The pioneering Ammann roller eARX 26-2 with fully electric drive will be on display at our stand at MATEXPO.

The machine is different from other machines by the absence of a combustion engine and hydraulic components, resulting in low maintenance and higher environmental sustainability. These features were decisive for BESIX Infra to choose this machine.

31.08.2023

Hitachi Construction Machinery unveils two new Zaxis-7 compact excavators

Hitachi Construction Machinery puts owners and operators in control of its latest range of Zaxis-7 compact excavators. The new ZX95US-7 and ZX95USB-7 Stage-V compliant models provide owners with opportunities to increase profits and reduce costs. Their enhanced comfort and safety features allow operators to feel at ease in the cab while performing productively.

29.08.2023

Van Moer en Zonen: KMC 400P

Van Moer en Zonen will be specializing more and more in large-scale demolition work, as well as earthworks and sanitation. In addition to the existing Hitachi machines, the company has invested in a KTEG KMC 400P demolition machine.

The machine is equipped with a large demolition reach of 24 meters with a tool weight of 3 tons.

28.08.2023

Discover Luyckx and Ultimated's range of products at MATEXPO

At this 40th anniversary edition of Matexpo, Luyckx and Ultimated will once again be showcasing a number of new features and innovations at booth A12, covering more than 1,600 m². In addition to the full range from Kubota and Hitachi, there will be some new models on display and we will be focusing on attachments for machines. New this year is our Green Corner with numerous emission-free machines.

23.08.2023

Young & talented at Luyckx

"It was better in the old days", "this generation doesn't know what work is", "they're spoiled brats" – all clichés that do nothing to improve the image of young employees at companies. What about the up-and-coming young talent at Luyckx? Do they have a different attitude to things at work and outside of work or is there actually no such thing as a generation gap? Or… is it even better nowadays?

08.08.2023

AMMANN CUSTOMER MAGAZINE - AUGUST 2023

Ammann's new customer magazine is here!

This edition includes:

- Going on the grid: innovative material prevents reflective cracking

- Plant fuel savings: burn less with ADX

- E-plate power: electric machines bring muscle

- Mixing old and new: components blended into new asphalt plant

Read the full magazine here.

20.07.2023

Hitachi iGround Control 23

iGround Control 23 - The latest edition of Hitachi Construction Machinery's online magazine.

Featuring a number of interesting items:

- HCME expands custom solutions with first installation of Leica Geosystems

- Digital solutions: find out how HCME and their dealer network are embracing the shift to digitalisation in construction and helping customers improve efficiency and reduce costs

- Highlights from IRE and SaMoTer

Read the magazine here.

19.07.2023

Win a Luyckx coloring book!

Our brand new coloring book is waiting for your creative touch! From tractors to excavators, this book is a perfect way for kids to unleash their creativity.

19.06.2023

Visit us at Libramont's fair!

Once again this year we will be at the Libramont agricultural, construction and agri-food fair. Every year they welcome nearly 200 000 visitors, 700 exhibitors and 4000 brands on a 200 000 m² site.

Be sure to come and have a look! Among other things, we will present Kubota's newest mini excavator: the KX085-5.

We welcome you from July 28 to 31. You can find us at stand 70.01.

19.06.2023

Discover what Luyckx has to offer at MATEXPO

MATEXPO is a monument among trade fairs. 40 editions already. Few trade fairs have such a rich history as MATEXPO. At MATEXPO you will find the latest machines, techniques and equipment from the construction industry.

02.06.2023

BLOG: Digidate with Luyckx

The Luyckx tagline ‘Minds & Machinery’ gives it away a bit, of course. The company located in Brecht combines smart minds with the distribution and service of high-quality machines. Digitalisation is then never far away…

01.06.2023

ENJOY 20% DISCOUNT ON ORIGINAL NEW HOLLAND FILTERS

Enjoy a 20% discount on original New Holland filters!

30.05.2023

Kubota launches next-generation 8 tonne mini-excavator

Kubota has enhanced its extensive range of innovative construction machinery with the launch of a new 8.5 tonne mini-excavator, providing operators with advanced performance and superior operation.

30.05.2023

Our farmers and contractors in full action

Our customers are catching up in a very short period of time. That also shows this T7.270 at full dawn. This beautiful photo was taken early in the morning at 5 a.m. with the rising sun and a hint of haze.

23.05.2023

COLLECTORS ITEM: LEGO SCALE MODEL HITACHI ZX350LC-7

On the occasion of Luyckx's 70th anniversary, we are launching an exclusive LEGO set in collaboration with Tom Van Mol. This unique scale model of the Hitachi ZX350LC-7 excavator promises to entice collectors with its detailed design.

15.05.2023

Tractor dedication to benefit Athletes for Hope Rehab Meadow

The Rural Guilds of Brecht are organizing a tractor dedication this year on Sunday, July 23. The tractors will gather at Luyckx from 11.30 am.

04.05.2023

Hitachi wheel loader ZW180-7 with remote radio control

In cooperation with the specialized company Remoquip Remote Control Systems, the first Hitachi ZW180-7 was converted with radio control. The machine will be used immediately for clearing explosives and landmines.

27.04.2023

Info session electric weed control

We would like to invite you to an information session on electric weed control.

The technology was developed by Zasso - New Holland. This machine combats the plant systemically from the roots to the green parts above ground. It irreversibly destroys the cell membranes and interrupts sap flows, killing the plant instantly.

26.04.2023

New Hitachi wheelloader ZW160-7

Hitachi recently introduced a new next-generation model from its Stage V-compliant wheel loader range. The ZW160-7 has been designed to put operators in complete control of their workspace with industry-leading safety features and unrivalled comfort in the cab. Owners will feel in total control of their profit – thanks to its versatility, low total cost of ownership and exceptional efficiency – as well as their fleet and workload, due to remote monitoring tools and services provided by Hitachi.

04.04.2023

Additional drone footage Luyckx Special Applications

Between the fields in Brecht, we're still working hard to finish our second branch. We can't wait to show you the final result soon!

31.03.2023

Impression of job day 2023

Thank you for your presence during our job day! It was great to meet many motivated candidates.

29.03.2023

Second-hand for sale: Hitachi KMC 520-5

Secondhand Hitachi High Demolition (KMC 520-5) for sale!

16.03.2023

Luyckx equips excavator with Remoquip remote control

We recently equipped a third excavator with a Remoquip remote control! A useful tool to preserve the safety of the operator of the machine in places where there is a potential danger of collapse, for example. This machine is being used to demolish cooling towers of a nuclear power plant that has now been out of service for 10 years.

03.03.2023

Focus on West Flanders branch office - Luyckx Izegem

When you hear the name Luyckx, you immediately think of the head office in Brecht and perhaps also the Luyckx division in far-off Dubai. But customers in West Flanders know better; they can call on the staff in Izegem. We felt it was high time we placed the focus on the West Flanders branch office, so we arranged to talk to (almost) the entire Izegem team.

24.02.2023

Luyckx Izegem will undergo a complete makeover

At the end of the year we will start the complete renewal and renovation of our branch in Izegem!

22.02.2023

HVO diesel fuel approved for Ammann, Hitachi, Kubota and New Holland machines

Research has shown that all Ammann, Hitachi, Kubota and New Holland machines are approved to use HVO diesel fuel.

03.02.2023

Ammann Customer Magazine - January 2023

A new edition full of interesting topics.

What can you read in this edition?

- Emissions: the use of electric drives is more than a trend

- A modern asphalt-mixing plant

- New product releases Bauma

- as1 Argon View: new plant interface helps operators succeed

Read more here.

01.02.2023

Jan De Nul utilises new Hitachi ZX690LCH-7 in Belgium

Jan De Nul Group is utilising a new ZX690LCH-7 to work alongside other Hitachi machines on a specialist earthmoving project at a reservoir situated at Trois-Ponts, in the province of Liège, Belgium. The new Zaxis-7 model has joined three other large (an EX1200-6, ZX870LCR-5 and ZX490LCH-6) and four medium (three ZX350LC-6s and a ZX225USLC-6) excavators.

01.02.2023

New Year's reception

Our annual New Year's reception is always a nice time where we take a moment to look back on the past year.

Our good intentions? To honor our 70th anniversary with lots of #character, #spirit and #action.

09.01.2023

Ceulemans’ large Hitachi excavators aid flood protection

The Belgian contractor Ceulemans Fr & Co has invested in a pair of Hitachi ZX490LCH-6s that are involved in aiding flood protection in The Netherlands. The Berlaar-based company owns and operates a 30-hectare clay pit at Schelle, from which the large Zaxis excavators dig under licence up to 2,700 tonnes per day to a depth of 15 metres.

05.01.2023

Collection LEGO® Hitachi scale models

LEGO specialist Tom Van Mol has already built several impressive excavators. These are now all on display at Luyckx!

21.12.2022

Luyckx expands: drone images show new site

We recently demolished the old buildings on the site that will soon accommodate part of our activities. A brand-new building will soon be constructed where we will be able to meet our customers' needs even more, in all comfort.

21.12.2022

Lego® scale model Hitachi ZHY350-7

LEGO specialist Tom Van Mol once again recreated an impressive 1/20-scale excavator down to the smallest detail.

07.12.2022

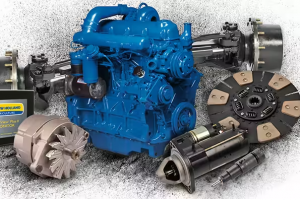

Reman has it all!

Reman has it all!

- 100% original

- 2 years warranty

- Significant discounts

- 100% durable

07.12.2022

Join us in remaining alert in the fight against phishing

We have noticed a huge increase in the number of phishing emails. For example, you may receive an email asking you to transfer payments to offshore/new bank accounts or to provide login credentials (username/password).

Since we consider information security of both our clients and ourselves very important, we want to prevent these practices.

02.12.2022

MARTENS DEMOCOM TAKES EX1200-7 HIGH DEMOLITION INTO SERVICE

This week Martens Democom took the new EX1200-7 high demolition into service.

01.12.2022

BLOG: Ultimated

Going the extra mile, or, in other words, taking care of everything. Luyckx is well-known for this among its customers. But not everyone is familiar with Ultimated, a joint venture between Luyckx and 3D-Consult (an independent service provider for machine control and 3D modelling). Together, they form a unique one-stop shop for companies in (road) construction, infrastructure and earthworks. Ultimated’s Sam Van Campenhout will tell you all about it…

17.11.2022

ZHY350LCH-7 dual fuel at hydrogen fueling station

The ZHY350LCH-7 dual fuel has been on trial for some time now at Terranova's green site, where work on a green energy landscape is in full swing. It is being refueled regularly during this test phase at a hydrogen refueling station of CMB.Tech while waiting for delivery to the site.

14.11.2022

Exceptional financing promotion : from 0.99% financing!

Exceptional financing promotion!

Benefit now from financing starting at 0.99%.

08.11.2022

Invest in 2022 and benefit from a 25% investment deduction

In order to prevent the economy from sinking, the Belgian government has decided to make the investment deduction possible until 31 December 2022. One-man businesses, liberal professionals and 'small' enterprises can claim the benefit. This measure is now extended for investments made until December 31, 2022.

07.11.2022

Luyckx invests in zero-emission excavators

In order to satisfy the ever-increasing demand for zero-emission excavators, we are bringing the ZE85, the ZE135 and the battery load system Powertree fast loader developed by KTEG to the market.

02.11.2022

Luyckx and Pacton join forces for package deals

To meet the increasing demand for package deals of a stone trailer with accompanying mobile crane, we have entered into an agreement with Pacton. Luyckx can now offer the full combination of "Kennistrailers". These are available from stock from January 2023.

24.10.2022

Survey ZX-7 models

Last month we received a request from Hitachi Construction Machinery to visit some ZX-7 machines with a delegation from Japan. They wanted to find out what our customers thought of the ZX-7 machines. We therefore went to visit Denys, Grobelco, Roebben Jan BVBA and Van Loo-Peeters. The findings of the operators were noted down by the manufacturer's representatives and taken to Japan for analysis.

19.10.2022

Kubota opens new skid-steer loader plant in America

Kubota opened their new skid-steer loader plant in Kansas on Monday.

11.10.2022

Ammann addresses changing industry at Bauma 2022

Roadbuilding businesses today must advance sustainability, improve connectivity – and increase productivity, too.

Ammann’s presence at bauma 2022 in Munich recognises this new world, which is reflected in the company’s show theme of, “Sustainability. Productivity. Connectivity.”

10.10.2022

Celebrate 50 years of HCME at Bauma

Celebrate 50 years of HCME’s success and innovation in Europe with them at this year’s Bauma exhibition. We’ll honour the people and partnerships that have helped HCME become what it is today – and look forward to building a better future together for generations to come by revealing our solutions for zero-emission and digital construction sites.

10.10.2022

Visit the Kubota Smart Energy Solutions Corner at Bauma 2022

Besides the complete range of Kubota products, you can discover the Kubota Smart Energy Solutions Corner at Bauma 2022.

16.09.2022

3X Celebration at Luyckx

We were joined by the presidents of Hitachi Construction Machinery Europe!

05.09.2022

XPower XPU: Electrical weed control for urban applications

The future of herbicides is the XPower:

- A proven alternative weeding technique

- Electrophysical destruction of weeds and invasive plants

- Based on a closed, uniform and targeted electrical circuit

- Works down the roots: XPower treats the plant from the leaves to the roots in the soil

05.09.2022

Successful edition Matexpo Demo Days 2022

Thank you for paying us a visit at the Matexpo Demo Days! Herewith some pictures of the atmosphere.

05.09.2022

Agriculture Day: it starts with us

We are counting down to Agriculture Day on the third Sunday in September. Visit agricultural and horticultural businesses and find out how it really works.

29.08.2022

Connect with Luyckx at Bauma 2022

Luyckx would like to invite you to Bauma in Munich, which will take place from 24 October to 30 October.

09.08.2022

Promotion Kinshofer/Demarec demolition and sorting grabs

Promotion of three different Kinshofer/Demarec demolition and sorting grabs.

08.08.2022

Contact us for more info about PLM: Precision land management

Luyckx partners with New Holland for precision land management.

08.08.2022

Save the date: fair weekend New Holland

The dealers of New Holland province Antwerp organize a weekend where all CNH products are exhibited.

25.07.2022

BLOG: D'Hooge Schouw

Minds and machinery are Luyckx's baseline. It is where smart minds and skilled hands work together to create exceptional machines. To achieve this, Luyckx is constantly investing in the modernisation of its machinery and in the company's true strength: its people. Recently, it gave the company canteen a new location, a new interior and a new name: D'Hooge Schouw. We interviewed HR employees Esmeralda and Inge and Project Manager Mik.

20.07.2022

A beautiful gift from New Holland

We had the honor of receiving a beautiful gift for our 70th anniversary yesterday from New Holland.

20.07.2022

Video quick coupler Kubota -5

We often get the question: "How does this work?".

And because manuals often are complicated and time-consuming, we like to make things easier for our customers.

12.07.2022

Win Luyckx colouring book

No more boredom during the holidays!

Finding solutions is in our DNA. Are your children bored? Then download the Luyckx colouring pages here.

29.06.2022

BLOG: Middle East Crane

Luyckx has been a household name on the Belgian market for many years now but not everyone knows that the Brecht-based company is also active in Dubai. In his early twenties Wim Aernouts travelled to the Middle East for Luyckx and he founded Middle East Crane. It was the start of an ambitious adventure...

01.06.2022

Subsidy scheme for dual fuel H2 powered machines

We received good news today! The dual fuel technology is included in the Limitative Technology List of Flanders. This was announced by VLAIO, the contact point for entrepreneurs in Flanders.

31.05.2022

BLOG: Luyckx Special Applications

The engineers and technicians at Luyckx achieve ‘miracles’ every day. So it’s high time to put the Special Applications department in the spotlights. Miracle workers Jos Luyckx, Louis Vinck (foreman), Kris Meeus (engineering manager) and Johan Stes (Special Applications mechanic) tell us with much enthusiasm why they are so excited about the construction of special applications…

30.05.2022

Middle East Crane invests in Jebel Ali Freezone

Recently, Middle East Crane has invested in the additional expansion of storage and workshop facilities in the Jebel Ali Freezone.

20.05.2022

Ammann customer magazine - May 2022

A new summer edition packed with interesting topics

Topics include

- AFW 150-2 eliminates manual paving

- Ammann compactors a perfect fit for unique application

- Servicelink hardware reliable, affordable and easy to retrofit

- ...

Curious?

Read on.

18.05.2022

Kuhn GA13131 four-rotor circular rake available

This four-rotor circular rake from Kuhn is available from stock.

18.05.2022

TLS 15 container system in stock

We can deliver the TLS 15 container system with container loading bucket from stock.

12.05.2022

"Sneukeltocht" Landelijke Gilde Brecht en Sint-Lenaarts

The Landelijke Gilden of Brecht and Sint-Lenaarts are organizing a "Sneukeltocht" this year on June 19th, 2022. This edition one of the stops will be at Luyckx.

11.05.2022

First step towards zero-emission propulsion with Kennis cranes R14 and R16 E-Power

With the Kennis cranes R14 and R16 E-Power powered by a battery pack, we are taking a first step towards zero-emission propulsion of mobile cranes.

14.04.2022

BLOG: Luyckx. The story...

This year Luyckx is celebrating the 70th anniversary of its founding. A perfect moment to get the 3 children of the founders, Louis and Céline, together for a chat about hard work, enthusiasm and what it´s like working in a pure-bred family business.

01.04.2022

Does the undercarriage of your Kubota or Hitachi need a replacement?

Benefit now from a revision in our workshops in Brecht and Izegem at a reduced hourly rate.

31.03.2022

Wake-upcall nitrogen policy

Yesterday the agri-food chain came together at our company. Approximately 5,000 jobs in the province of Antwerp are at stake because of the nitrogen policy.

28.03.2022

Hydrogen excavator in test phase Terranova

Last week this machine went from Brecht to Zelzate for the real deal. It will now run for a while at the Terranova site, where they continue to work on a green energy landscape.

23.03.2022

Hitachi launches largest model in Zaxis-7 series: ZX220W-7

The new Hitachi ZX220W-7 wheeled excavator holds strong appeal for both owners and operators, with an extensive range of features designed to help control their profitability, comfort, safety and uptime.